Unlock Financial Success

Are you looking for a trusted advisor to travel with you on the path to success? Look no further! At By The Books Bookkeeping and Tax, we get more of what we want by helping our clients get more of what they want. We specialize in providing tax planning and advisory strategies tailored to your unique needs. Let us help you navigate the path to your goals and financial success!

Using Numbers to Find Great Opportunities

Welcome to By the Books Bookkeeping and Tax, where we know numbers—meaning you don’t have to! Specifically, you can rely on our skilled and professional team to transform your numbers into clear, simple results that, yes, make sense! For proactive, personable, and productive accounting and tax services, contact us today!

Why Choose Us?

Happy Clients

Trusted Advisors

Proven Track Record

Dedicated Service

SERVICES

Accounting Services We Offer

When it comes to small business advisory, tax, and accounting services you don't have to do it alone! We tailor our approach to meet you where you are, and we make the journey to success with you. Your success is our success!

Advisory Services

Our advisory services aim to enhance cash flow, profitability, wealth, and overall business success for you.

Tax Planning and

Preparation Services

We're here to assist with income tax preparation, filing, planning, sales tax, franchise tax, and business tax requirements.

Accounting Services

We offer bookkeeping, outsourced controller, payroll, and QuickBooks® services—all tailored for small and mid-sized businesses.

Cash Flow Forecasting Services

We assist small business owners in understanding their cash positions for clarity and provide insights on the benefits of cash flow forecasting.

Bookkeeping Services

Let us handle your bookkeeping tasks, freeing you to focus on running your business efficiently and effectively. Our attention to detail ensures accurate financial records, giving you peace of mind.

Payroll Services

We offer expert payroll services tailored to your needs, providing complimentary quotes and discussing options for hassle-free management.

Discover Our Latest Blog Articles

Stay current with our dynamic blog articles, offering valuable insight into the ever-evolving accounting and tax industries.

Six Things to Look for Every Month in Your Accounting Reports

While Net Profit and your cash balance are probably the first two numbers you look at on your monthly Profit and Loss Statement, don’t stop there. There are a lot more gems you can glean if you dig a little deeper and look through the following six lenses at your data.

1. Automation Opportunities

Look at your labor detail reports as well as professional and outsourcing expenses to see what areas might be ripe for automating. Is your admin spending too much time scheduling meetings? If so, automate everyone’s calendars. Are you finding places where duplicate data-entry is driving up costs? Get Zapier or another integration solution.

On the flip side, cancel tech spending where you are no longer using the app and get those expenses off your books.

2. Duplicate or Excessive Expenses

Where are you paying for things twice on your Profit and Loss Statement? Where could you scale down? As an example, if you are renting 5,000 square feet but now only need 2,000 because everyone wants to work from home, see if you can re-negotiate your lease or sublet that extra space.

Do you have redundancy in your insurance policies? Perhaps your liability and your business umbrella both cover workers compensation. See what you can do to reduce the overlap.

You might only need three phone lines but are paying for five. Retainer and recurring expenses should be inspected carefully; are you getting what you’re paying for?

3. Outsourcing Opportunities

Are their companies that can do tasks or work cheaper and better than how you are doing them now? If so, outsourcing could be a profitable option to look into further.

4. Indications of Fraud, Theft, or Excessive Risk

As owners, we need to protect our business investment, and we should always be on the lookout for signs that our investment may be at risk. If your numbers look odd or unexpected, you should be skeptical and investigate further.

5. Tax Savings Situations

Investing in tax planning almost always yields great results, especially this year with new tax relief available to qualifying businesses. Get help from a tax professional to see if you qualify or are close to qualifying for tax deductions, credits, and savings.

6. Sales Growth

This list would be remiss without mentioning the obvious opportunities of finding ways to grow sales. Your sales results can give you an idea of where more growth can occur, where promotion opportunities exist, and where completely new revenue sources can be created.

After you’ve examined your cash number and your net profit, try these six new filters to get even more ideas to run your business better.

Your Trusted Partner for All Accounting and Tax Services

Count on us as your trusted advisor and reliable partner for all your accounting and tax needs, tailored specifically for small to mid-sized businesses. With our expertise and dedication, we ensure your financial success.

Get In Touch Today!

Mon-Fri, 8am-5pm

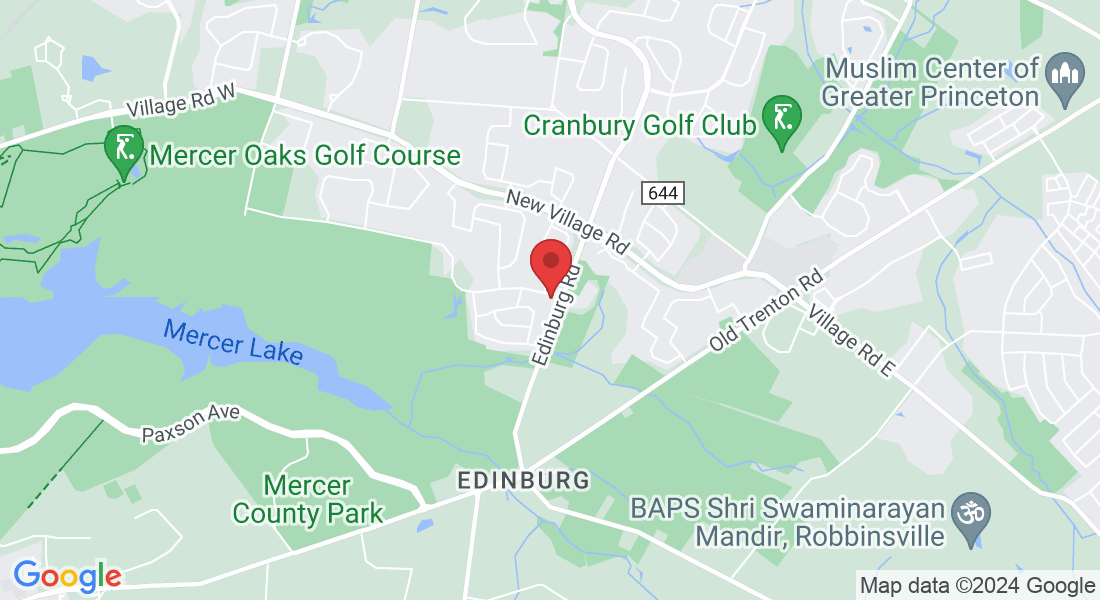

By The Books Bookkeeping and Tax

202 Conover RoadWest Windsor, NJ 08550, United States

© Copyright 2024. By The Books Bookkeeping and Tax.

All rights reserved. Privacy Policy

Professional Web Design Powered by ThriveFuel Marketing

2022 All Rights Reserved.