Unlock Financial Success

Are you looking for a trusted advisor to travel with you on the path to success? Look no further! At By The Books Bookkeeping and Tax, we get more of what we want by helping our clients get more of what they want. We specialize in providing tax planning and advisory strategies tailored to your unique needs. Let us help you navigate the path to your goals and financial success!

Using Numbers to Find Great Opportunities

Welcome to By the Books Bookkeeping and Tax, where we know numbers—meaning you don’t have to! Specifically, you can rely on our skilled and professional team to transform your numbers into clear, simple results that, yes, make sense! For proactive, personable, and productive accounting and tax services, contact us today!

Why Choose Us?

Happy Clients

Trusted Advisors

Proven Track Record

Dedicated Service

SERVICES

Accounting Services We Offer

When it comes to small business advisory, tax, and accounting services you don't have to do it alone! We tailor our approach to meet you where you are, and we make the journey to success with you. Your success is our success!

Advisory Services

Our advisory services aim to enhance cash flow, profitability, wealth, and overall business success for you.

Tax Planning and

Preparation Services

We're here to assist with income tax preparation, filing, planning, sales tax, franchise tax, and business tax requirements.

Accounting Services

We offer bookkeeping, outsourced controller, payroll, and QuickBooks® services—all tailored for small and mid-sized businesses.

Cash Flow Forecasting Services

We assist small business owners in understanding their cash positions for clarity and provide insights on the benefits of cash flow forecasting.

Bookkeeping Services

Let us handle your bookkeeping tasks, freeing you to focus on running your business efficiently and effectively. Our attention to detail ensures accurate financial records, giving you peace of mind.

Payroll Services

We offer expert payroll services tailored to your needs, providing complimentary quotes and discussing options for hassle-free management.

Discover Our Latest Blog Articles

Stay current with our dynamic blog articles, offering valuable insight into the ever-evolving accounting and tax industries.

Financing Options for Small Businesses

All small businesses need cash to operate, and there are many ways to generate the required cash. The most common way that many businesses get started is when the owner makes an investment from their savings or other personal cash. But what if it’s not enough? In this article, we’ll take a look at some of the more common ways to finance a business.

Community banks

Most community banks are big proponents of small businesses, so this is a great place to start. Establish a relationship first by opening business checking and savings accounts. Then apply for a line of credit, which is a pre-approved loan that you can tap when you need it.

If you plan to purchase a building or equipment, you should be able to get a loan by using the asset as collateral. Business expansion loans are possible too; you may be able to borrow against your accounts receivables or other contracts with guaranteed income.

Beyond community banks, there are also many online lending agencies, banks, credit unions, and community development financial institutions (CDFIs) to apply to for a loan.

When applying for a loan, you will likely need a good personal credit rating and either a strong business plan or audited financial statements to show the financial condition of your business.

Partners and investors

Investors such as angel investors or venture capitalists can provide cash in exchange for either a debt or an equity position in your business. Obtaining financing this way is a big decision since you are no longer the sole owner of the company if you give away some of your equity.

Another option is to bring a partner into your business. Typically, the partner will provide cash as well as management or other skills that complement yours and be active in running the business with you.

Government support

There are many government programs to help with small business financing this year due to the pandemic. The Small Business Administration has loans and programs available to small businesses on a consistent basis. This year, they are also managing the forgivable Paycheck Protection Program (PPP) loans, economic disaster funding, shuttered venue operator loans, and restaurant relief grants, to name a few.

You might also want to see what’s available from your county, city, and community governments. Last, organizations like the Small Business Development Council (SBDC) can provide space, funds, and training to small businesses in their area.

Nonprofits and educational institutions

Your business may also be able to benefit from nonprofits and educational institutions that provide grants, scholarships, and other funding opportunities to businesses and business owners in certain categories. For example, your local chamber of commerce may have programs and funding options available for local businesses.

Factoring

Factoring is an option for businesses with accounts receivable balances. A cash advance can be made with the accounts receivable balances as collateral. This type of loan is common in the retail fashion industry where items are ordered months in advance of when they are sold, causing a cash flow gap.

Crowdfunding

Crowdfunding has been made popular by platforms such as Kickstarter. A business can apply on these platforms for funding, and individuals can make contributions. Sometimes the business will promise goods or services in exchange for funding.

Credit card advances

It’s common for owners to put startup expenses on and use cash advances from their personal credit cards. This is one of the most expensive ways to fund a business and should be used as a last resort.

The fine print

All financing options come with fine print. Terms and interest rates vary significantly. Sometimes, there is a cliff, where you have to pay everything back all at once. Be sure to carefully read any agreements you sign and run them by a lawyer if you don’t understand them. Your personal financial situation could suffer greatly if you aren’t careful.

For example, businesses that got a PPP loan and later received a buyout offer may not be able to sell because the loan agreement prohibits them from doing so. If they didn’t read the fine print and sold the company anyway, they are now personally liable to pay back the PPP loan proceeds.

If you have questions or want to discuss financing options, please feel free to contact us anytime.

Your Trusted Partner for All Accounting and Tax Services

Count on us as your trusted advisor and reliable partner for all your accounting and tax needs, tailored specifically for small to mid-sized businesses. With our expertise and dedication, we ensure your financial success.

Get In Touch Today!

Mon-Fri, 8am-5pm

By The Books Bookkeeping and Tax

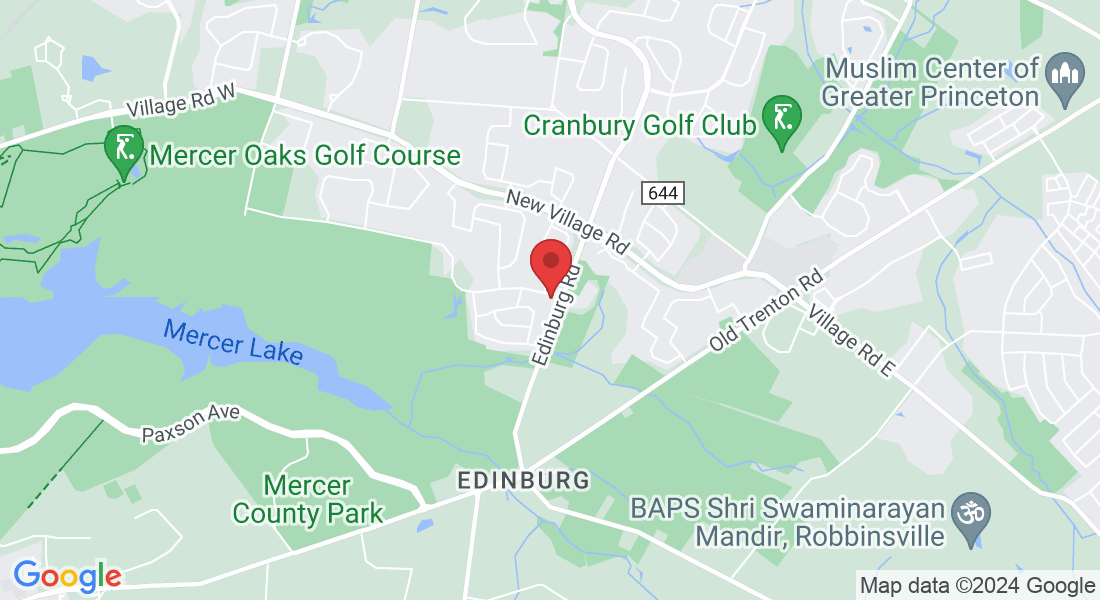

202 Conover RoadWest Windsor, NJ 08550, United States

© Copyright 2024. By The Books Bookkeeping and Tax.

All rights reserved. Privacy Policy

Professional Web Design Powered by ThriveFuel Marketing

2022 All Rights Reserved.